Are you drowning in a sea of receipts, invoices, and financial reports? Take a deep breath and dive into the world of technology expense management software. This digital lifesaver is transforming the finance management game, making it a breeze for businesses and individuals to keep their financial heads above water.

What is Technology Expense Management Software?

At its core, technology expense management software is your financial command center. It’s where algorithms meet user-friendly design to give you a bird’s-eye view of your spending. Wave goodbye to the old-school spreadsheet shuffle and embrace a sleek, streamlined approach to managing your money.

- Track every penny with precision

- Analyze spending habits with ease

- Set and smash your financial goals

Whether you’re a bustling business or a savvy spender, this software is about to become your new best friend.

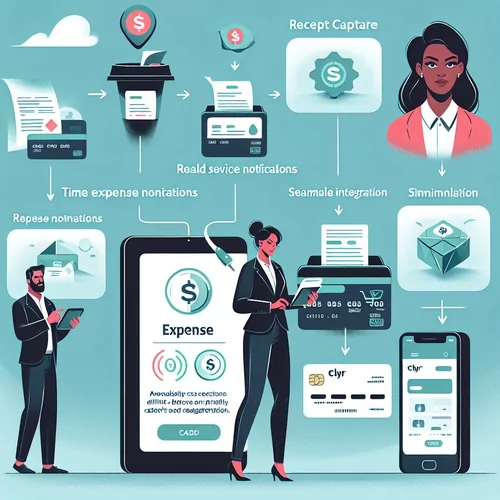

The Key Features of Technology Expense Management Software

What makes technology expense management software so special? Here’s the lowdown on its standout features:

- Expense Tracking: Centralize your costs and cut through the clutter.

- Budgeting Tools: Budget like a boss and keep your spending in check.

- Invoicing Capabilities: Invoices in a snap? Yes, please!

- Vendor Management: Keep your vendors in line and your expenses optimized.

- Integration with Financial Tools: Play nice with your other financial favorites for a seamless experience.

These features aren’t just fancy frills—they’re the financial muscles that flex to fit your needs.

Benefits of Using Technology Expense Management Software

Why should you jump on the technology expense management software bandwagon? Let’s count the ways:

- Time Savings: More time for what matters—like growing your business or enjoying your life.

- Cost Reduction: Spend smarter, not harder, and watch your savings soar.

- Data Accuracy: Sayonara, spreadsheet errors. Hello, pinpoint precision.

- Better Decision-Making: Make moves with confidence, backed by solid data.

- Fraud Detection: Keep those financial foes at bay with eagle-eyed software.

These perks are just the tip of the iceberg. Dive deeper, and you’ll find a treasure trove of tools designed to declutter your financial life.

Real-Life Success Stories: How Technology Expense Management Transformed Financial Management

Don’t just take our word for it—check out these real-world wins:

- Company XYZ: From financial chaos to streamlined success, thanks to technology expense management.

- Freelancer ABC: Bidding farewell to billing blues and saying hello to hassle-free invoicing.

- Individual DEF: Personal finance panic? Not anymore. Now it’s all about clarity and control.

These stories aren’t fairy tales—they’re financial makeovers made possible by the power of technology.

Choosing the Right Technology Expense Management Software for Your Needs

Picking the perfect technology expense management software is like finding the right pair of shoes—it’s got to fit just right. Consider:

- User-Friendliness: No one likes a complicated contraption. Keep it simple.

- Scalability: Think big. Will the software grow with you?

- Data Security: Keep your financials under lock and key.

- Integration Capabilities: Make sure it plays well with your existing tech stack. For example, expense integration with Quickbooks? We got it!

- Customer Support: When you need help, you want it fast and friendly.

Tick these boxes, and you’re on your way to a match made in financial heaven.

Getting Started: Setting Up and Implementing Technology Expense Management Software

Ready to roll with technology expense management software? Here’s how to hit the ground running:

- Evaluate Your Current Financial Processes: Know where you stand before you leap.

- Select the Right Software: Armed with your checklist, choose your champion.

- Migrate Data: Bring over your financial history with care.

- Create Categories and Budgets: Organize your outgoings and set spending limits.

- Educate Users: Share the knowledge to ensure smooth sailing.

Follow these steps, and you’ll be managing your money like a pro in no time.

Maximizing the Potential: Tips for Effective Use of Technology Expense Management Software

Want to get the most out of your technology expense management software? Keep these tips in your financial toolkit:

- Regularly Review and Analyze Reports: Stay in the know and on top of your game.

- Automate Expense Tracking: Let the software sweat the small stuff.

- Set Realistic Budgets: Dream big but budget wisely.

- Collaborate with Team Members: Two heads (or more) are better than one.

- Stay Updated: Keep your software fresh and your finances fresher.

With these strategies, you’ll be squeezing every drop of value from your financial software.

Integrating Technology Expense Management Software with Other Financial Tools

Think of technology expense management software as the maestro of your financial orchestra. When it’s in harmony with your other tools, you’ll hear the sweet sound of efficiency. Look for integration options and make beautiful music together.

Overcoming Challenges and Optimizing Results with Technology Expense Management Software

Every hero faces hurdles, and technology expense management software is no exception. Here’s how to leap over common obstacles:

- Resistance to Change: Champion the change with training and transparency.

- Data Accuracy: Keep a keen eye on your numbers and nip errors in the bud.

- Integration Issues: Stuck? Reach out for support and get back on track.

- Security Concerns: Stay sharp on security and safeguard your financial fortress.

Face these challenges head-on, and you’ll come out on top, every time.

As you embark on this journey, remember that Clyr is your ally in the quest for financial mastery. With our platform, you can connect any existing card, integrate with major management platforms, and enjoy real-time expense notifications. We’re not just another tool; we’re your partner in simplifying job costing and expense management automation solutions.

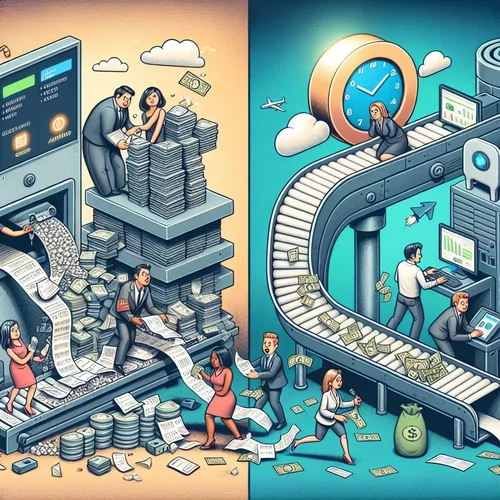

The Evolution of Financial Management: From Spreadsheets to Software

Once upon a time, financial management was a labyrinth of paper trails and manual calculations. Spreadsheets were the go-to, with their endless grids waiting to be filled with data. But as the business world evolved, so did the tools. Enter technology expense management software, a beacon of efficiency in a sea of numbers.

- Goodbye manual entry, hello automation

- From static data to dynamic insights

- Collaboration across continents in a click

With the advent of this software, the financial management narrative shifted from tedious to transformative, empowering businesses to make data-driven decisions faster than ever before.

Customizing Your Technology Expense Management Software Experience

One size does not fit all, especially when it comes to managing finances. Customization is key, allowing users to tailor their experience to their unique needs. Whether it’s setting up custom categories for expenses or creating bespoke reports, efficient expense management solutions adapt to you, not the other way around.

- Personalize dashboards for at-a-glance insights

- Create custom approval workflows for expenses

- Integrate with tools you already use and love

With customization, technology expense management software becomes an extension of your business, flexing and scaling as you grow.

Security Measures in Technology Expense Management Software

In the digital age, security is paramount. Financial data is sensitive, and the software that manages it must be a digital fortress. From encryption to multi-factor authentication, technology expense management software comes armed with an arsenal of security measures to protect your financial data from the villains of the virtual world.

- Encryption: The shield that guards your data

- Multi-factor authentication: A double-lock on your financial vault

- Regular security audits: Keeping the watchtower manned

Rest easy knowing that your financials are under lock and key, safe from prying eyes and nefarious cyber threats.

How Technology Expense Management Software Supports Remote Teams

The modern workforce is increasingly mobile, with remote teams and digital nomads becoming the norm. This shift calls for tools that support this new way of working. Technology expense management software bridges the gap, ensuring that no matter where your team is, your financial management remains cohesive and controlled.

- Access financial data from anywhere, at any time

- Collaborate in real-time, regardless of location

- Stay connected to your financial pulse with mobile apps

With these capabilities, remote teams can stay in sync with the company’s financial health, contributing to a unified financial strategy.

The Role of AI and Machine Learning in Expense Management

Artificial Intelligence (AI) and Machine Learning (ML) are not just buzzwords; they’re revolutionizing how we handle finances. These smart technologies learn from your spending patterns, offering insights and automating tasks that once required human intervention. From categorizing expenses to predicting future spending, AI and ML in technology expense management software are like having a financial wizard by your side.

- Automated categorization: AI sorts your expenses, so you don’t have to

- Predictive analytics: ML forecasts your financial future

- Fraud detection: AI vigilantly watches over your transactions

Embrace these intelligent features and watch your financial management evolve from reactive to proactive.

The Future of Finance: Predictive Analytics in Expense Management

Imagine a world where your financial software not only tracks past transactions but also predicts future spending trends. Welcome to the era of predictive analytics in efficient expense management solutions. This cutting-edge feature harnesses historical data to forecast upcoming expenses, giving businesses a crystal ball into their financial future.

- Anticipate seasonal spending spikes with ease

- Plan for future investments with confidence

- Adjust budgets proactively, not reactively

By leveraging predictive analytics, companies can strategize with foresight, ensuring they’re always one step ahead in the financial game.

The Environmental Impact of Going Digital with Your Finances

It’s not just about the numbers; it’s about the planet, too. Going digital with your finances isn’t only a smart business move—it’s an eco-friendly one. By reducing the need for paper-based systems, technology expense management software helps in cutting down on waste and conserving natural resources.

- Less paper means fewer trees cut down

- Digital data storage reduces physical space and energy consumption

- Online transactions eliminate the carbon footprint of physical transport

Embrace a greener approach to finance management and contribute to a healthier planet while optimizing your bottom line.

Comparing Top Financial Reporting Software for Field Teams

Field teams need top financial reporting software that’s as mobile and dynamic as they are. When comparing options, it’s crucial to consider features like real-time updates, ease of use on mobile devices, and the ability to handle the unique challenges of fieldwork.

- Real-time expense tracking software for instant financial updates

- Mobile-friendly interfaces that empower teams on the go

- Robust data capture capabilities for accurate job costing

Choose a solution that empowers your field teams to report expenses effortlessly, ensuring seamless financial data synchronization for field services.

How to Choose Between Different Automated Financial Reporting for Out-of-Office Teams

When your team is out in the field, traditional financial reporting just doesn’t cut it. You need automated financial reporting for out-of-office teams that’s as flexible and responsive as your workforce. Here’s how to pick the perfect partner for your financial reporting needs:

- Assess mobile accessibility and user experience

- Ensure compatibility with your existing tech stack

- Look for features that support simplifying job costing with financial software

With the right tools, your out-of-office teams can enjoy the same level of financial control and insight as their in-office counterparts.

As we navigate the ever-changing landscape of finance management, it’s clear that technology is not just a luxury—it’s a necessity. From the evolution of spreadsheets to the latest in predictive analytics, the journey has been nothing short of revolutionary. And at the heart of this transformation is Clyr, your steadfast companion in the quest for financial clarity and control. With Clyr, you’re not just keeping up with the times; you’re setting the pace.

In Conclusion

Whether you’re managing a team of remote warriors or a fleet of field experts, Clyr’s suite of integration-friendly financial tools for property management and service companies ensures that every transaction is captured, every penny is accounted for, and every financial decision is data-driven. It’s time to say goodbye to the cumbersome, paper-laden processes of yesteryear and hello to a brighter, more sustainable financial future.

So, as you look ahead, remember that with Clyr, you’re not just adopting software; you’re embracing a smarter, greener, and more efficient way to manage your finances. A way that’s built for today’s dynamic business environment and ready for tomorrow’s challenges. With Clyr, you’re always one step ahead, with real-time insights and predictive prowess at your fingertips. It’s not just about managing expenses; it’s about mastering them. And with Clyr, mastery is just the beginning.